Improving Customer Lifetime Value

Improving Customer Lifetime Value: Proven Strategies for Growth

It feels like the old business playbook is getting ripped up. For years, the main goal was simple: get more customers. Now, that whole approach is showing its cracks. The real game isn't just about making one-time sales; it's about building genuine, long-term relationships that turn repeat buyers into your most profitable asset. This shift creates a predictable, resilient business that can actually thrive, even when finding new customers gets ridiculously expensive.

Why Customer Lifetime Value Matters Now More Than Ever

Let's cut through the jargon. In today's market, focusing on customer lifetime value (CLV) isn't just a nice-to-have metric for a dashboard—it's the absolute foundation of sustainable growth. I've seen too many businesses get caught up in the constant, expensive chase for new leads, completely overlooking the goldmine they're already sitting on: their existing customers.

The math behind this is just undeniable. The cost of acquiring a new customer has gone through the roof. Some reports show that acquisition costs have exploded by as much as 222% in the last eight years alone. Think about that. It makes every single dollar you spend on keeping a current customer happy incredibly powerful.

The impact is staggering: a tiny 5% increase in customer retention can boost your company's profitability by anywhere from 25% to a whopping 95%. This isn't a small bump. It's a fundamental shift in your financial health, showing just how much more profitable it is to nurture what you have rather than constantly chasing what you don't.

This is more than just a metric; it’s a strategy. Prioritizing CLV forces you to build a better business from the inside out—one that can weather market storms and outlast the competition. It’s about finally understanding the true, long-term worth of a happy customer.

The Real Power Is in Retention, Not Just Acquisition

The conversation in savvy business circles has completely changed. The most successful companies I see aren't just celebrating new logos; they're obsessed with keeping their customers engaged, satisfied, and excited to come back. This change in focus pays off in some very tangible ways.

Financial Predictability: A high CLV gives you a stable, predictable revenue stream. This makes it so much easier to forecast accurately and plan for real growth without just guessing.

Healthier Profit Margins: It's a simple fact: retained customers tend to spend more over time. They also frequently buy higher-margin products or services because they already trust you.

The Best Kind of Marketing: Happy, loyal customers become your most passionate brand advocates. They drive high-quality referrals that cost a tiny fraction of what you'd spend on paid ads.

Invaluable Customer Insights: Long-term relationships are a treasure trove of data. You learn what your customers really want, helping you refine your products and map out the entire customer experience. If you want to get this right, check out our guide on customer journey management.

To put it plainly, the financial logic of retention is just too compelling to ignore. The cost-to-profit ratio tells a clear story.

Acquisition Costs vs. Retention Profitability

This table highlights the stark financial differences between acquiring new customers and retaining existing ones.

The data is clear: investing in the customers you already have is not just a feel-good strategy; it's the most direct path to a healthier, more profitable business.

Ultimately, making CLV a priority transforms your company. It forces you to build better products, deliver better service, and forge connections that pay dividends for years. To really unlock that growth, you need to have the right systems in place. For a closer look at what works, explore these effective SaaS strategies to increase customer lifetime value.

Finding and Focusing on Your Most Valuable Customers

Let's be honest: not every customer is created equal. Some are the absolute lifeblood of your business, while others... not so much.

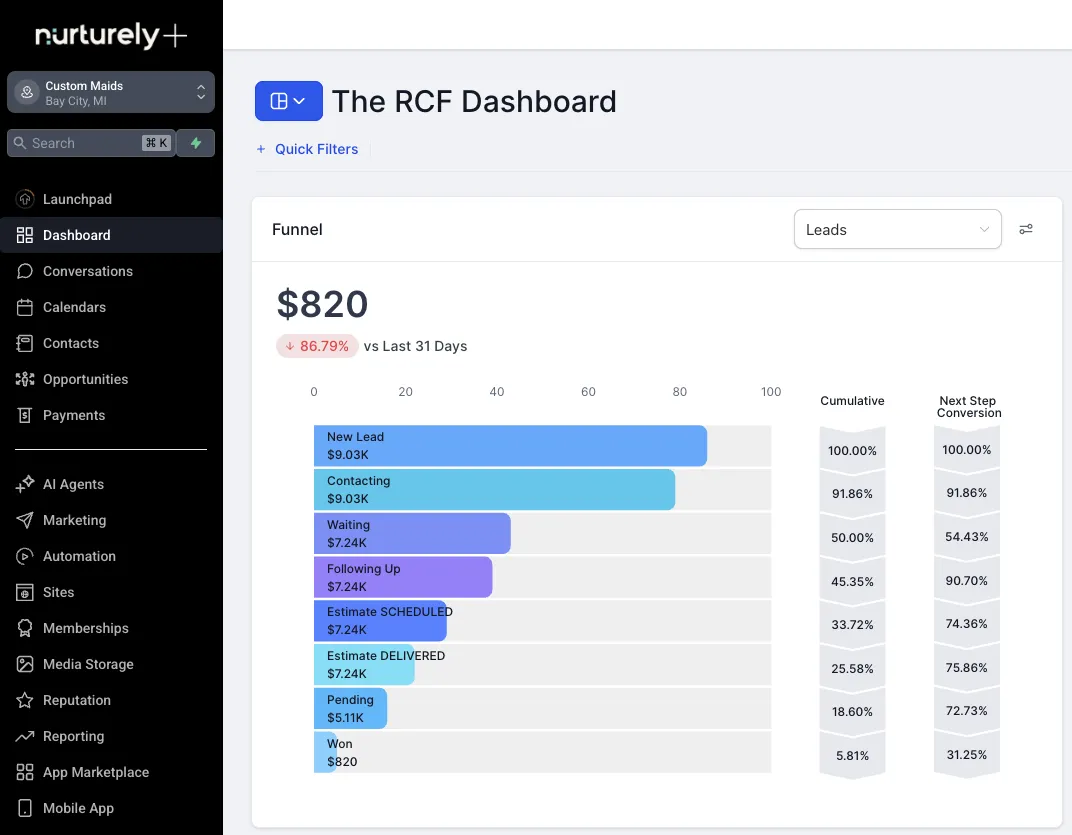

One of the most powerful things you can do to grow is to apply the classic 80/20 rule. You've probably heard of it—the idea that a small handful of your customers are driving the vast majority of your revenue. This isn't just some business school theory; it's a practical, data-driven strategy you can put to work right inside your all-in-one CRM.

By digging into your sales data, you can stop guessing and start knowing who your best customers really are. These are the folks who buy more often, spend more money, and stick around for the long haul.

This whole process is really a cycle. You identify who these VIPs are, engage with them in a way that makes sense, and measure what works. Then you do it all over again with even better data.

It’s about being smarter, not just busier.

Pinpoint Your VIPs with Smart Segmentation

Your CRM isn't just a fancy address book. It’s a goldmine. The first step is to start slicing up your customer data into meaningful groups based on what they actually do. Forget fuzzy metrics and focus on tangible actions.

I recommend creating dynamic lists that track a few key indicators:

Purchase Frequency: Who are your weekly or monthly regulars? For a lawn care business, this is the difference between clients on a recurring mowing schedule and someone who calls once for a spring cleanup.

Average Order Value (AOV): Who consistently spends more per job? A plumber might notice that clients who approve a full water heater replacement have a much higher AOV than those who just call for a leaky faucet.

Customer Longevity: Who’s been with you the longest? These loyal customers provide predictable income and, more often than not, are your best source of word-of-mouth referrals.

Using an all-in-one platform like Nurturely+, you can automate this. For instance, you could set a rule to automatically tag any customer who makes three purchases in 90 days as a "Frequent Buyer." Just like that, they’re no longer just a contact; they're a recognized VIP.

It's wild how often the Pareto principle holds true. We see it all the time: roughly 20% of customers really do generate about 80% of a company’s revenue. Focusing on this group isn't just a good idea; it's how you build a sustainable business.

Build Personas for Your Best Customers

Once you know who your best customers are, the next question is why. What makes them tick? This is where you move beyond the raw numbers and build simple personas. The goal is to answer one question: What do my best customers have in common?

Start looking for patterns in their:

Acquisition Channel: How did they find you? Was it a Google search, a Facebook ad, or a referral from a neighbor down the street?

Services Purchased: Do they always buy a specific high-end package, or do they mix and match different services?

Engagement History: Do they open every email you send, or are they more likely to respond to a text message?

A general contractor, for example, might find that their "High-Value Remodeler" persona is typically a homeowner between 40-55 who found them via a local search. They might also notice this group responds incredibly well to an email showcasing a gallery of past kitchen remodels.

Armed with that knowledge, you can stop shouting into the void and start having real conversations. You can create campaigns that speak directly to what you know works, nurturing those critical relationships and encouraging even more high-value business.

This data-backed approach completely shifts your mindset. You're no longer just trying to get more customers; you're focused on attracting and keeping the right customers. The result is a business that’s more efficient, more profitable, and a whole lot more resilient. As research shows, highly engaged customers can have a lifetime value that is 3 to 5 times higher than others. You can see how the 80/20 rule impacts CLV for yourself—it’s a total game-changer.

Deeper Relationships Through Personalization? It's Not What You Think.

Let's be honest, generic, one-size-fits-all marketing is a great way to kill your customer lifetime value. For years, "personalization" meant sticking a {{first_name}} tag in an email subject line. That’s not going to cut it anymore.

Today's customers don't just prefer a personalized touch; they flat-out expect it. They want you to prove you know who they are and what they actually need. This means digging into the rich data you already have in your CRM—purchase history, browsing behavior, past conversations—and using it to build a real connection.

Turn All That Customer Data Into Relevant Experiences

Your all-in-one CRM isn't just a database; it's a collection of stories about each customer's journey with your business. The real magic happens when you use those stories to make their next interaction even better. For any service business, this is where you can leave your competition in the dust.

Think about a local landscaping company. Instead of blasting out a generic "Spring is here!" email, they could use their CRM to get much smarter:

Clients who had new sod installed last fall? They get an email with specific tips on "Your First Spring Caring for New Sod," plus a convenient link to book a fertilization service.

Customers who only bought mulch last year? Send them a targeted offer for a "Complete Spring Cleanup" package that includes mulching. You're showing them the logical next step.

High-value clients on recurring maintenance plans? Give them a heads-up and early access to book premium services like aeration or seasonal planting before your schedule is swamped.

This isn't just selling; it's providing genuine, timely value based on what you already know about them. It makes your customers feel seen and understood—and that's the bedrock of a long-term relationship.

It turns out, what customers really want from personalization is relevance. A recent survey found that 53.9% of consumers define personalization as a brand simply recommending products based on their past purchases. It's that straightforward.

Let Automation Handle the Heavy Lifting

Manually personalizing every single interaction is a recipe for burnout. It's just not scalable. This is where a true all-in-one platform like Nurturely+ becomes your secret weapon. You can set up automated systems that deliver these tailored experiences for you, day in and day out.

Dynamic Website Content: Imagine your website changing based on who's visiting. A returning customer who hired you for pressure washing last year could see a homepage banner that says, "Time for a Touch-Up? Check Out Our Window Cleaning Packages." It's so much more powerful than a generic welcome mat.

Personalized Email and SMS Flows: You can build automated follow-up sequences triggered by specific actions. For instance, if a customer gets a quote for a new fence but doesn't pull the trigger, an automated flow could send them a case study of a similar project after three days. A week later? Maybe a small, time-sensitive discount to nudge them over the finish line.

By weaving this kind of smart personalization into your strategy, you make sure every touchpoint is adding value, not just noise. This consistent, relevant communication is a massive driver for improving customer lifetime value and turning one-time buyers into people who rave about your business.

You can’t fix problems you don't know exist. That sounds obvious, but it's a trap so many businesses fall into. They only hear from a customer when something has gone completely, horribly wrong.

Improving customer lifetime value starts with the simple act of listening. But you can't be passive about it. You need to flip the script and build a system that actively seeks out what your clients are thinking and feeling, moment to moment. This isn't just about putting out fires; it's about mining for gold. The insights you gather are the real blueprint for building a stickier product, a better service, and ultimately, a more profitable relationship with every single customer.

Going Beyond the Suggestion Box

Let's be real: a dusty suggestion box on the counter doesn't cut it anymore. A modern feedback system has to be woven directly into your daily operations, powered by your all-in-one CRM. It should start with simple tools that make it incredibly easy for customers to give you a quick signal.

One of the most effective tools I've ever used for this is the Net Promoter Score (NPS). It’s a simple, one-question survey: "How likely are you to recommend us to a friend or colleague?" The beauty is in its simplicity and how easy it is to automate.

You can set up your CRM to automatically trigger an NPS survey after key moments in the customer journey. For example, a landscaping company could send one out a week after finishing a big project. A pest control business could send it after a successful treatment.

Imagine a plumbing company that automatically texts an NPS survey 24 hours after a service call. That single data point instantly segments customers into Promoters (your fans), Passives (they're neutral), and Detractors (they're unhappy). You get a real-time pulse on your business's health without lifting a finger.

A critical mistake I see people make is just collecting the score and stopping there. The real value is in the follow-up. Understanding why a customer gave you a 2 or a 10 is where you find the actionable insights that drive real change.

The Art of Closing the Loop

Collecting the feedback is just step one. The real magic, the part that actually builds loyalty, is what we call "closing the loop." This means having a rock-solid process for responding to and acting on what you learn—not just with one customer, but across the entire business.

Your CRM is the engine for this. Here’s how it should work:

For Detractors (The Unhappy Ones): This is your red-alert moment, but it's also a huge opportunity. An automated workflow in your CRM can immediately create a high-priority task for a manager to personally call any customer who leaves a low score. A sincere apology and a concrete plan to make it right can—and often does—turn an angry customer into one of your most loyal advocates.

For Promoters (Your Biggest Fans): These are your brand champions! Don't let their praise just sit in a spreadsheet. A simple, personalized thank-you goes a long way. But you can take it a step further: set up an automation that sends this group a polite request for a public review. This is how you build powerful social proof that attracts new business. We've seen this work wonders, and you can learn exactly how to automate client satisfaction reviews to make this process seamless.

This kind of systematic approach ensures no piece of feedback ever falls through the cracks. It proves to your customers that you’re actually listening and that their opinion matters. That feeling, more than anything else, is a cornerstone for building long-term loyalty and seriously improving your customer lifetime value.

Designing a Loyalty Program That Creates True Fans

Let's be honest. Most loyalty programs are just glorified discount schemes. Slapping a 10% off coupon on something might push a sale over the line, but it does absolutely nothing to build a real, emotional connection with your brand.

The goal isn't to get a single transaction; it's to create true fans. We want to design a program that makes your customers feel like insiders, fostering a kind of loyalty that goes way beyond a simple price cut. It’s a core piece of the puzzle when you're serious about improving customer lifetime value.

Think about it. What can you offer that makes your best customers feel seen, recognized, and special? It’s all about creating a sense of exclusivity and status that money alone can't buy.

Move Beyond Points and Discounts

While a simple points system is a classic for a reason, the loyalty programs that really move the needle today offer value that isn’t just about saving a few bucks. This is where you get to be creative and dial in rewards that your customers actually care about.

Let me give you a real-world example. Imagine a high-end landscaping company that wants to reward its best clients. They could set up a tiered program that looks something like this:

Tier 1 (Silver): Customers get a small discount on seasonal services. Standard stuff.

Tier 2 (Gold): They get the Silver discount, plus early access to book spring cleanups before the schedule gets slammed. Now we're talking.

Tier 3 (Platinum): Top-tier clients get all of the above, plus an exclusive annual consultation with the head landscape designer to map out their dream garden for the year. That’s an experience you can't just buy.

This kind of tiered system gives customers a clear reason to spend more to unlock a higher status. It directly boosts their lifetime value while offering something genuinely unique and desirable.

A well-designed program can deliver a massive return. One report found that 80% of companies with a loyalty program reported a positive ROI, with revenue being 4.9 times greater than the expenses. This shows that investing in loyalty pays for itself many times over.

Measuring the Real Impact on CLV

So, how do you know if your fancy new program is actually working? You have to measure its direct effect on your key CLV metrics. This is where your all-in-one CRM becomes absolutely essential. You need to be able to see, clear as day, how your loyalty program members behave compared to your regular customers.

Here are the key metrics I’d be watching like a hawk in my CRM:

Purchase Frequency: Are my loyalty members buying more often than everyone else?

Average Order Value (AOV): Does being in the program encourage them to spend more each time they buy?

Customer Churn Rate: Are we keeping loyalty members around longer than the general customer base?

By setting up this kind of tracking, you get a data-backed, no-fluff view of your program's performance. It also makes managing everything a whole lot simpler, since the CRM can do the heavy lifting.

For instance, you can set it up so that once a customer hits a certain spend threshold, the system automatically tags them as a "VIP." You can even automate data entry to make this process seamless, freeing up your team to focus on building relationships, not getting bogged down in repetitive tasks.

Look, even when you're completely sold on the idea, figuring out how to actually improve customer lifetime value can feel a bit overwhelming. Let's cut through the noise and tackle the most common questions and roadblocks businesses hit when they start putting these ideas into practice.

The goal here isn't to get lost in complicated theory. It's to give you clear, straightforward answers you can actually use. Think of this as your practical guide to navigating those first steps and making a real impact.

How Do I Calculate Customer Lifetime Value?

You really don't need a data science degree to get a handle on this. For most businesses, a simple and effective formula is the perfect place to start.

CLV = (Average Purchase Value) x (Average Purchase Frequency) x (Average Customer Lifespan)

Let's imagine you run a lawn care business. It might break down like this:

An average customer spends $150 each time you service their lawn (Average Purchase Value).

You service their lawn 4 times a year (Average Purchase Frequency).

On average, they stick with you for 3 years (Average Customer Lifespan).

Do the math: $150 x 4 x 3 = $1,800. Just like that, you have a powerful baseline to measure all your efforts against. As you get more sophisticated, you can start factoring in profit margins for an even more precise number, but this is a fantastic starting point.

What Is the First Step I Should Take to Improve CLV?

Before you do anything else, figure out who your best customers already are. Seriously, don't try to boil the ocean here. Just dive into your existing sales data and find the top 20% of your customers who generate the most revenue. It’s the classic 80/20 rule in action, and it works like a charm.

Once you have that list, start digging. What’s their story? Look at their purchase history, what services they buy, and how they first found you. This simple analysis will give you an incredibly clear picture of who you need to keep happy and, just as important, who you should be trying to attract more of.

The most impactful first step is almost always an internal one. Before you launch new programs or campaigns, just identifying and truly understanding your existing VIP customer segment gives you the strategic foundation for everything else. It’s the ultimate "work smarter, not harder" approach to growth.

Can Small Businesses Really Improve CLV with Limited Resources?

Absolutely. Improving customer lifetime value isn't some exclusive strategy reserved for giant corporations with massive marketing departments. To be honest, small businesses often have an edge because they can be more nimble and personal.

You don't need expensive software or a big team to make a difference. Simple, genuine actions can have a huge impact. Consider these low-cost, high-impact ideas:

Send a personalized thank-you email or text after a job is done. A little appreciation goes a long way.

Start a basic loyalty program. It could be as simple as a "buy 5, get 1 free" system.

Actively ask for feedback after every service. And here's the critical part: show you're listening by actually responding and making changes.

It's these small, consistent efforts that build the kind of trust that makes customers want to stick around for the long haul.

Ready to turn these ideas into action? With Nurturely Plus, you get all the tools you need—from CRM and automation to email marketing and reputation management—to build stronger customer relationships and boost your lifetime value. Start growing your business with Nurturely Plus today!